SECURED PROPERTY TAXES FREQUENTLY ASKED QUESTIONS

FAQs AND TERMS

The Los Angeles County fiscal tax year or tax roll year begins July 1 of one year and ends June 30 of the next year (e.g., July 1, 2023 through June 30, 2024). This is the 12-month accounting period used for the calculation and collection of property taxes.

The Treasurer and Tax Collector mails the Annual Secured Property Tax Bills each year in October to every owner listed on the Secured Tax Roll. Per State law, we mail all property tax bills no later than November 1.

The Annual Secured Property Tax Bill has two payment stubs. You may pay each installment individually or both installments simultaneously. The 1st installment payment is due on November 1 and becomes delinquent by the close of business on December 10. The 2nd installment payment is due on February 1 and becomes delinquent by the close of business on April 10. If the delinquency date falls on a Saturday or Sunday, by law, the Treasurer and Tax Collector extends the delinquency date to the close of business on the next business day. If the Treasurer and Tax Collector does not receive your payment by the delinquency date, or if the United States Postal Service does not postmark your payment on or before the delinquency date, the Treasurer and Tax Collector will impose a 10% penalty on each installment and a $10.00 cost on the 2nd installment per State law.

PAY ONLINE – Go to Online Payments 24 hours a day, 7 days a week up until 11:59 p.m. Pacific Time on the delinquency date.

- There is no cost to you for electronic check (eCheck) payments. You will need your Assessor’s Identification Number (AIN), which you can locate on your Secured Property Tax Bill. Each eCheck transaction is limited to $2,500,000.00.

- You may view a step-by-step video on how to make an eCheck payment at eCheck payment. The video is available in multiple languages.

- When paying by eCheck, your bank account must be Automated Clearing House (ACH)-enabled, meaning the transaction can settle through the ACH Network. If your bank account has a debit block to prevent unauthorized organizations from debiting your account via ACH, you must notify your bank to authorize ACH debits from Los Angeles County with a debit filter with the Company Identification Number of 0 0 0 0 0 7 9 1 6 1. Los Angeles County updated its Company Identification Number, so you must update this Company Identification Number if you previously had a debit filter on your bank account.

- You may also pay online by using major credit cards or debit cards. Each online credit/debit card transaction is limited to $99,999.99, including a service fee of 2.22% of the transaction amount (minimum $1.49 per transaction).

PAY BY CREDIT OR DEBIT CARD OVER THE TELEPHONE

We accept major credit card and debit card payments over the telephone. To pay by telephone, call toll-free 1(888) 473-0835. You will need the Assessor’s Identification Number (AIN), Year, and Sequence from your Secured Property Tax Bill to use this system. Each credit/debit card transaction is limited to $99,999.99, including a service fee of 2.22% of the transaction amount (minimum $1.49 per transaction).

BY MAIL

Please mail payments to:

LOS ANGELES COUNTY TAX COLLECTOR

P.O. BOX 54018

LOS ANGELES, CA 90054-0018

Do not mail your payments to any other address.

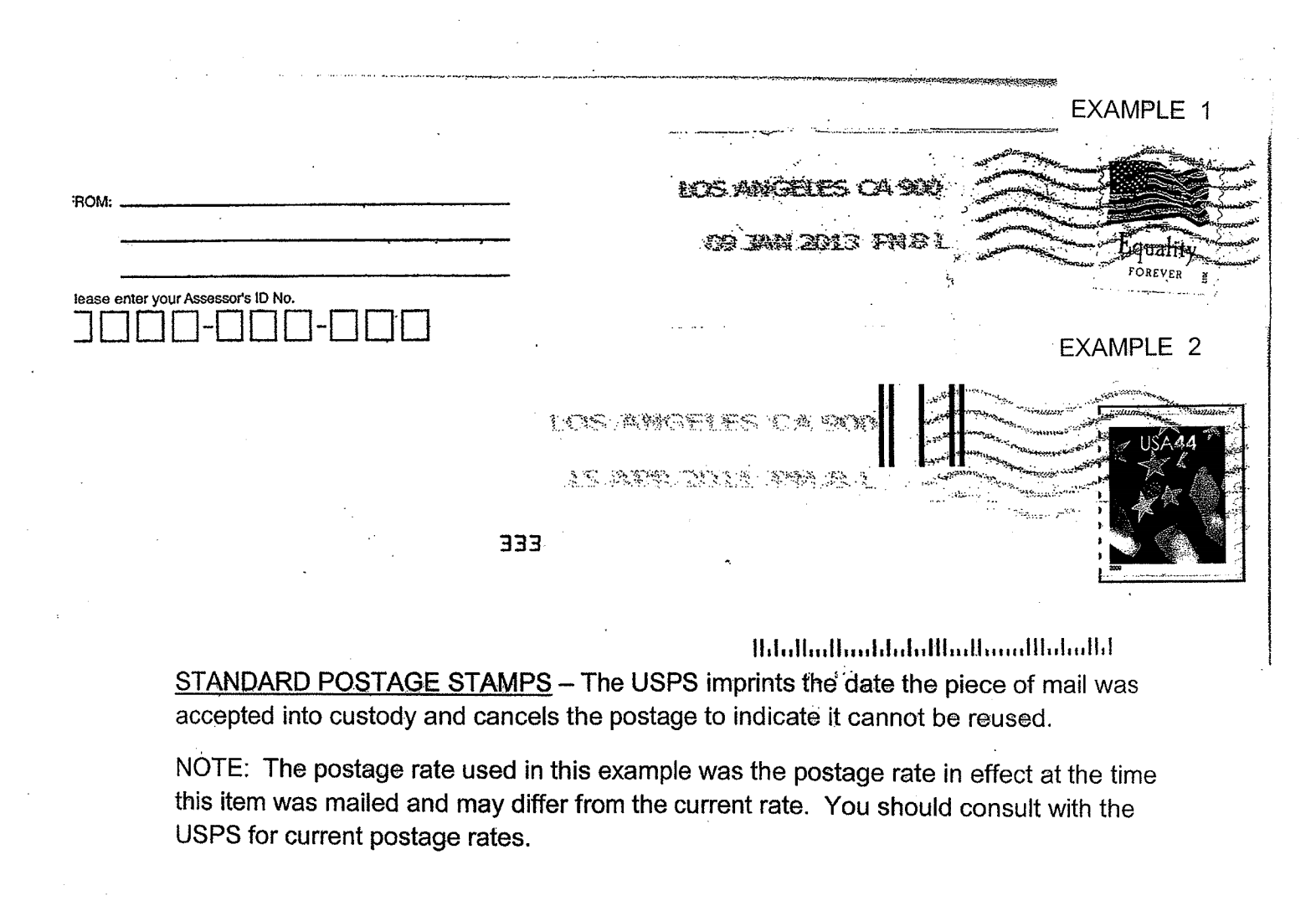

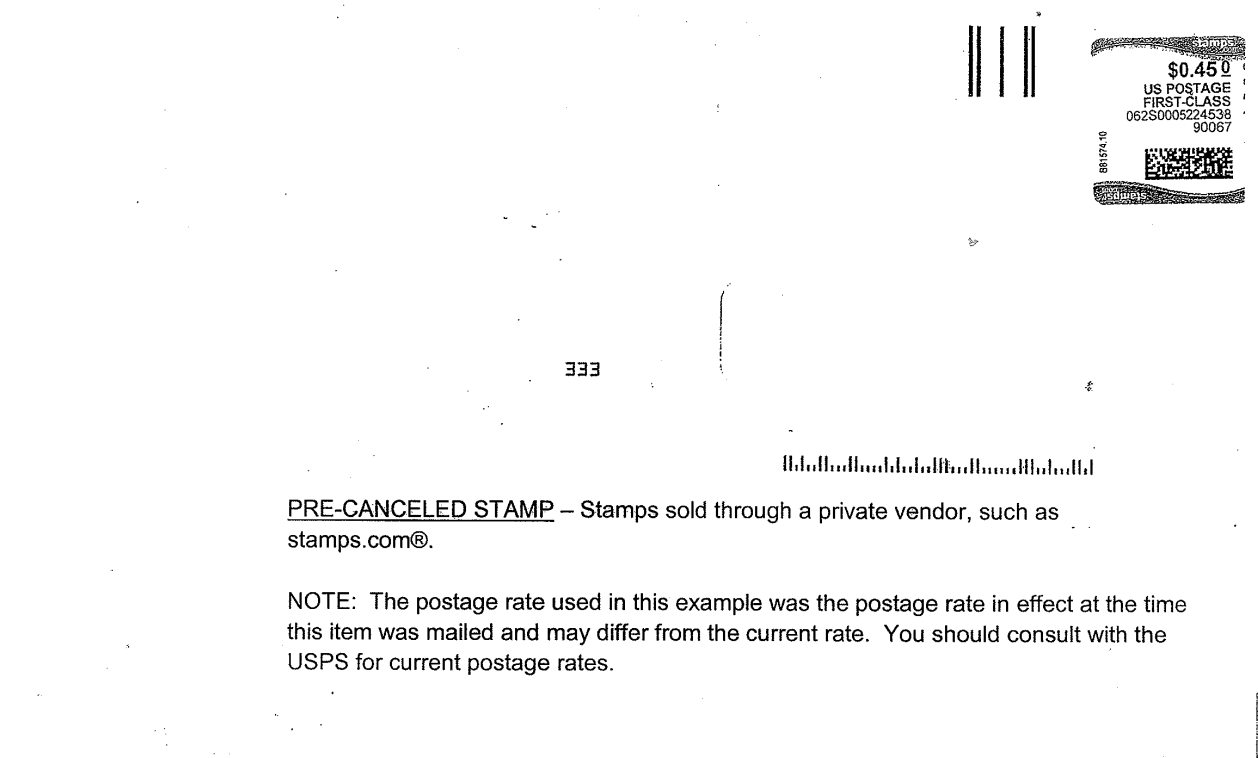

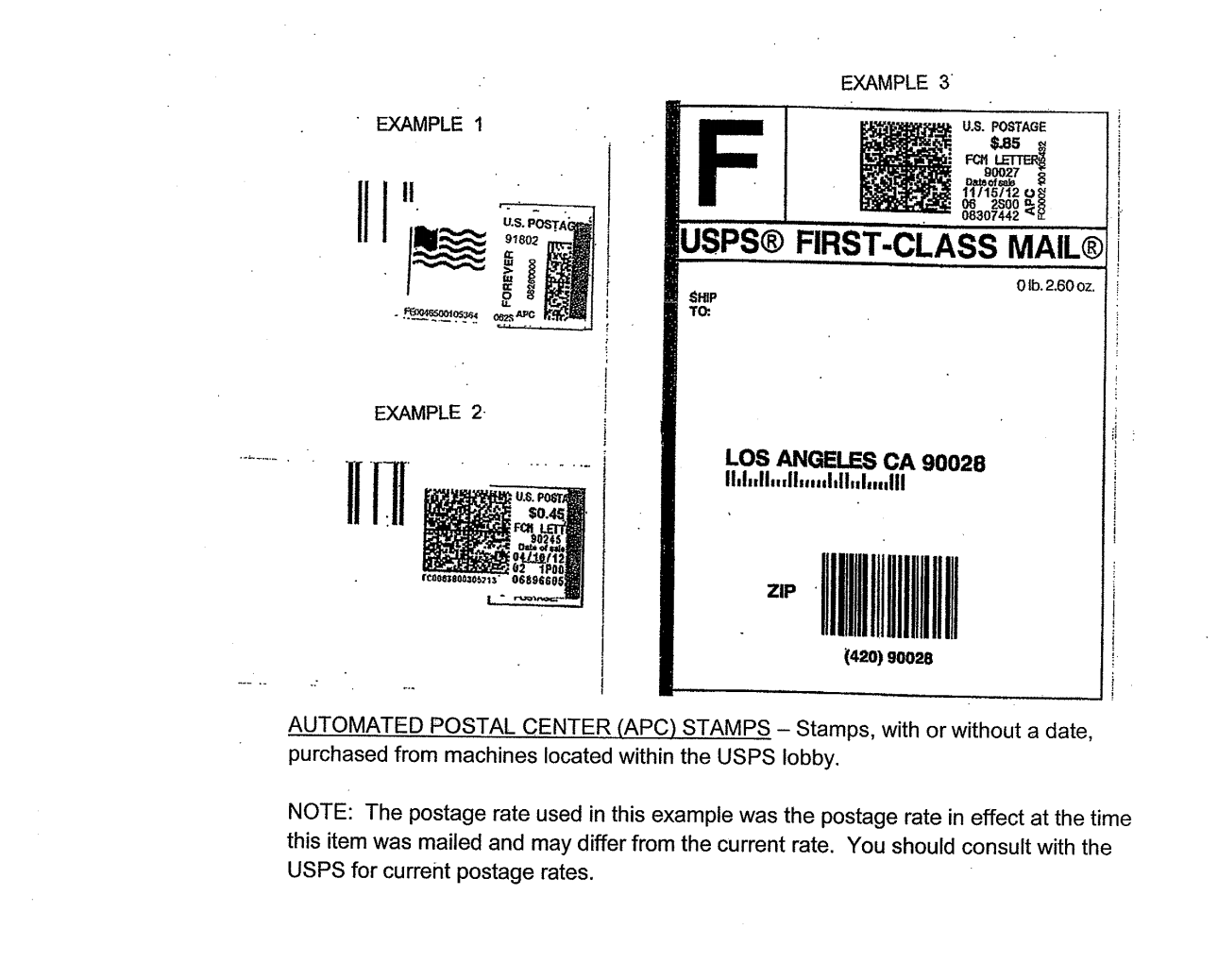

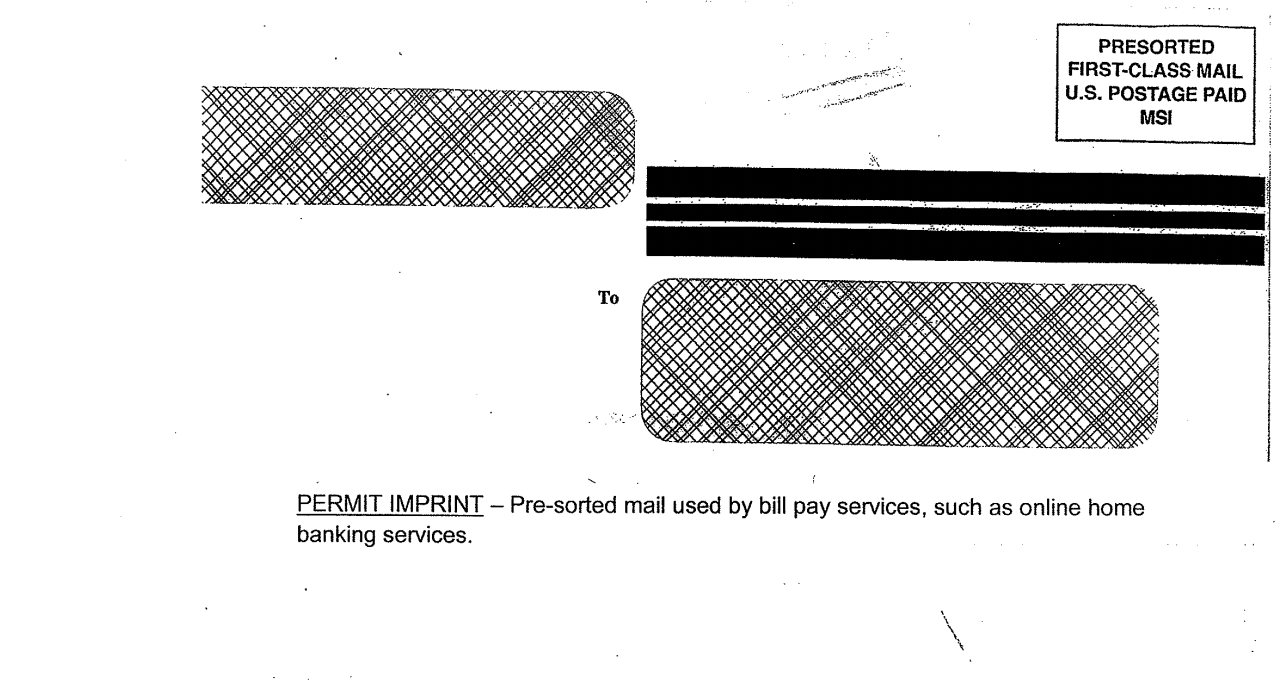

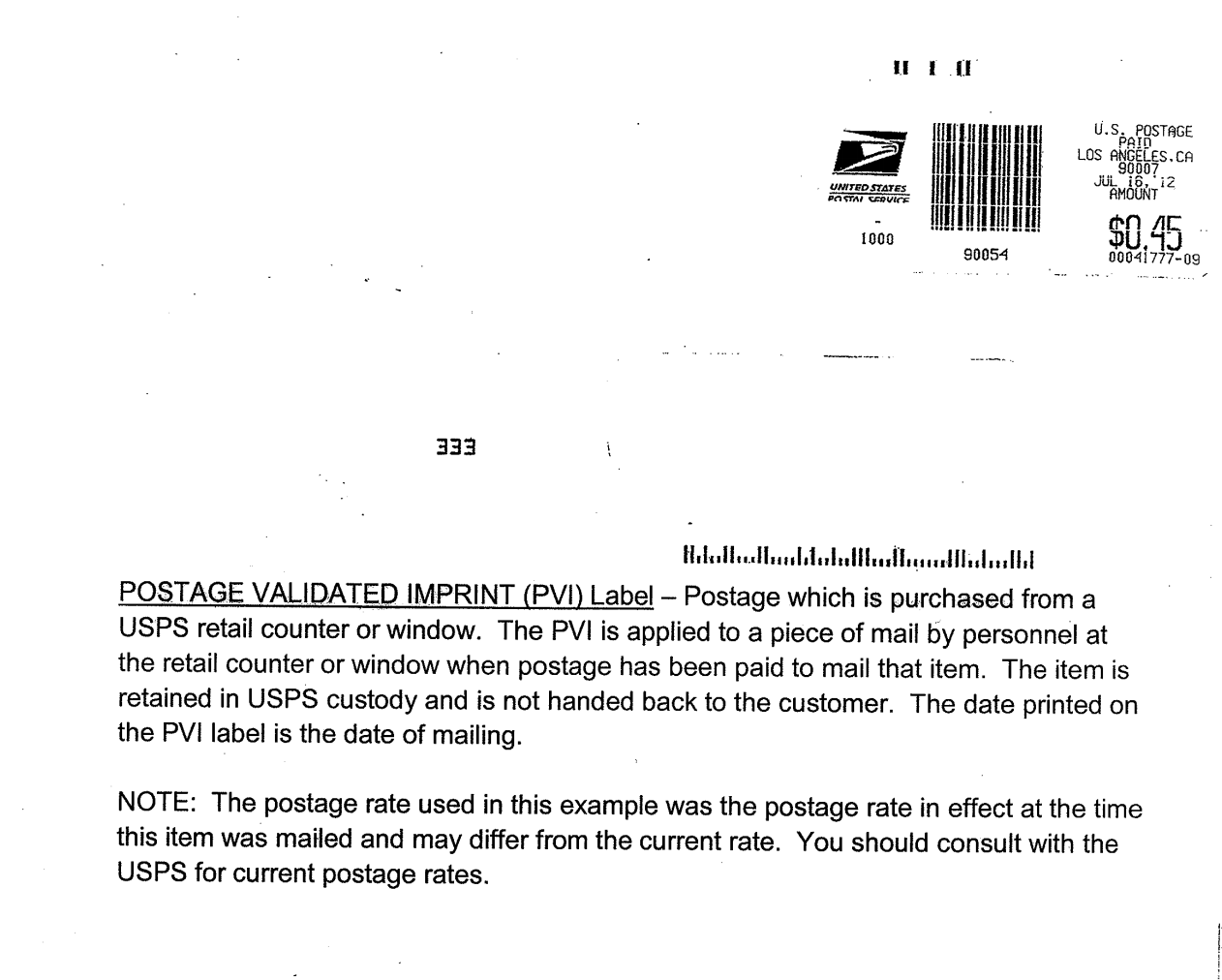

Property tax payments must be received on the last business day noted on the bill to make a timely payment (delinquency date) or United States Postal Service (USPS) postmarked by the delinquency date to avoid penalties. If we receive your payment after the delinquency date, with no postmark, the payment is late and we will impose penalties, in accordance with State law. We caution taxpayers who send their payments by mail that the USPS only postmarks certain mail depending on the type of postage used and may not postmark mail on the same day taxpayers deposit envelopes.

To assist taxpayers in understanding how to avoid penalties that could result from postmark issues, we have compiled important information on how to

“Avoid Penalties by Understanding Postmarks.”

PAY IN PERSON

- We accept cash, check, money order, cashier’s check, and major credit cards and debit cards at 225 North Hill Street, First Floor Lobby, Los Angeles, CA 90012, between 8:00 a.m. and 5:00 p.m. Pacific Time, Monday through Friday, excluding Los Angeles County holidays. Each credit/debit card transaction is limited to $75,000.00, including a service fee of 2.22% of the transaction amount (minimum $1.49 per transaction).

- We also accept payments at 335A East Avenue K-6, Lancaster, CA 93535, between 8:00 a.m. and 5:00 p.m. Pacific Time on the delinquency date of each Annual Secured Property Tax Bill installments only. You must make your payments by check, money order, cashier’s check, major credit cards or debit cards. We do not accept cash payments at this location. Each credit/debit card transaction is limited to $75,000.00, including a service fee of 2.22% of the transaction amount (minimum $1.49 per transaction).

Yes, you may make partial payments on your Annual Secured Property Taxes. In the event a property owner is unable to pay the total amount due, partial payments reduce the amount of delinquent/defaulted penalties imposed.

After the delinquency date for each installment (December 10 and April 10), a 10% penalty will be added to any unpaid balance per installment. A $10.00 cost for giving notice will be added to the 2nd Installment.

If your total payment for the current property tax year is not received or United States Postal Service (USPS) postmarked by June 30, any unpaid property taxes become defaulted on July 1. A $15.00 redemption fee will be charged, and defaulted property taxes will be subject to additional penalties of 1.5% of the base tax per month.

EXAMPLE (Assuming zero payment of property taxes)

Current Year Taxes, Penalties and Cost

| Installment Payment Due | Amount Due by Delinquency Date | 10% Penalty After December 10 or April 10 | Cost to Give Notice | Amount Due After Delinquency Date |

| 1st Installment (December 10) | $500.00 | $50.00 | $550.00 | |

| 2nd Installment (April 10) | $500.00 | $50.00 | $10.00 | $560.00 |

| Total | $1,000.00 | $100.00 | $10.00 | $1,110.00 |

Tax Defaulted Amount, Redemption Fee and Monthly Penalty After July 1

| Defaulted Taxes, Penalty and Cost | Redemption Penalty (1.5% of Base Tax Per Month) | Redemption Fee | Redemption Total Due by July 31 | Redemption Total Due by August 31 |

| $1,110.00 | $15.00 | $15.00 | $1,140.00 | $1,155.00 |

For all credit/debit card payments, the Treasurer and Tax Collector’s third-party payment processor charges a service fee of 2.22% of the transaction amount (minimum $1.49 per transaction). The County of Los Angeles does not receive or retain any portion of the service fee.

Most likely because your mortgage lender pays your property taxes for you. Each year in July, lending institutions provide the Treasurer and Tax Collector with listings of properties with “impound accounts,” and we incorporate that information into our Secured Tax Roll system. As a result, each year in October, we mail the Annual Secured Property Tax Bills for properties with impound accounts to the lending institutions and an Annual Property Tax Information Statement (Information Only) to the property owners. If you no longer have an impound account, you may use the payment stubs to pay your taxes. For questions regarding your impound account, you must contact your lender.

Annual Secured Property Tax Bills are mailed throughout the month of October, you may view a copy of your bill, once available, by visiting ttc.lacounty.gov/request-duplicate-bill.

The Treasurer and Tax Collector will continue to mail property tax information to your mailing address on file until you update your address with the Office of the Assessor. You may obtain a Change of Mailing Address form and requirements at assessor.lacounty.gov/homeowners/change-mailing-address.

Please mail the completed Change of Mailing Address form to:

Los Angeles County Assessor

500 West Temple Street, Department M/A

Los Angeles, California 90012-2770

The Treasurer and Tax Collector mails over 2.6 million Annual Secured Property Tax Bills each fiscal year, and as a result, you may find it difficult to reach us on the telephone. We will only respond to telephone inquiries for one parcel at a time. However, we have a great new way to obtain information without waiting on hold.

Owners of multiple parcels, real estate professionals, and title/escrow and lending companies may use our Secured Property Tax Information Request (Multiple Parcels) form. This form is designed to assist them with obtaining answers to questions, such as “Who paid the property taxes?,” “Are there any pending refunds for the current tax year?,” or “Why is a refund being issued?”

We will send an e-mail confirmation acknowledging receipt of the form and respond to all requests within three business days.

Typically, secured property taxes are prorated between the buyer and the seller during escrow. As a new property owner, you are responsible for any property taxes that were not paid as of the time escrow closed. It is your responsibility to obtain the Annual Secured Property Tax Bill. If you do not know your Assessor’s Identification Number (AIN), you can Look Up Your AIN and review Pay Your Property Taxes. Failure to receive a property tax bill neither relieves you of your responsibility to pay property taxes on time, nor does it allow the Treasurer and Tax Collector to cancel late-payment penalties.

The Treasurer and Tax Collector mails Annual Secured Property Tax Bills each year in October. This is the only Secured Property Tax Bill the Treasurer and

Tax Collector regularly mails each year. Depending on when the Office of the Assessor places the ownership change on the Secured Tax Roll, the Treasurer and Tax Collector could send the Annual Secured Property Tax Bill either to the previous owner or directly to you. If there are any remaining unpaid property taxes, and if you did not receive an Annual Secured Property Tax Bill from either the previous owner or the Treasurer and Tax Collector, you may request a copy by visiting ttc.lacounty.gov/request-duplicate-bill.

Escrow companies can only pay property taxes if the Treasurer and Tax Collector issues a property tax bill. From July 1 to October 1, the Annual Secured Property Tax Bills are not available. For escrows that settle during this period, escrow companies estimate the property tax amount due and debit/credit these estimated property tax amounts between the buyer and the seller from the proceeds of the sale as costs for the buyer and proceeds to the seller. Your Closing Statement will reflect these debits/credits, which the escrow company issued. If the escrow company paid any property taxes, you will see the payment amount made to the Los Angeles County Treasurer and Tax Collector on your Closing Statement. Please carefully review your Closing Statement to ensure that you understand whether or not you received a debit/credit at the close of escrow or if the escrow company issued a payment. If for some reason the escrow company overpaid the property tax amount due, we will refund the escrow company as we always refund the payer.

As a new property owner, you are responsible for any property taxes that were not paid at the time escrow closed. If you have an impound/escrow account, please consult with your lender/financial institution and determine who will pay the property taxes. For more information, go to New Property Owner page. We also encourage you to visit our website at propertytax.lacounty.gov, where you can obtain answers to the great majority of your questions, including how to request a copy of a property tax bill, obtain the amount due on any parcel, or find the tax payment history for the past three fiscal tax years.

Lenders/financial institutions do not usually pay Supplemental Secured Property Tax Bills.

Do not ignore the Supplemental Secured Property Tax Bill. In addition to the Annual Secured Property Taxes, you may also be responsible for paying Supplemental Secured Property Taxes. State law requires the reassessment of property, as of the first day of the month, following an ownership change or a new construction. A change in ownership or new construction that occurs between January 1 and May 31, results in two supplemental assessments and triggers two Supplemental Secured Property Tax Bills based on the assessments. The first Supplemental Secured Property Tax Bill is for the remainder of the fiscal tax year in which the event occurred. The second Supplemental Secured Property Tax Bill is for the subsequent fiscal tax year. Please refer to the shaded box with the Electronic Fund Transfer Number to identify the year of the Supplemental Secured Property Tax Bill.

If the Office of the Assessor reassesses your property at a higher value than stated on the Annual Secured Property Tax Bill, you will receive one or more Supplemental Secured Property Tax Bill(s). If the Office of the Assessor reassesses your property at a lower value, you will receive a refund.

If your lender or financial institution pays your Annual Secured Property Tax Bill using an impound or escrow account, contact your lender/financial institution as soon as possible.

Yes. If you disagree with the assessed value placed on your property, you can file an appeal with the Assessment Appeals Board. The filing date is within 60 days after the mailing date on the Notice of Assessed Value Change or Supplemental/Adjusted/Escaped Assessments Property Tax Bill.

To contact the Assessment Appeals Board, please call 213.974.1471.

Important

Filing an appeal does not suspend the obligation to pay property taxes. If you choose to appeal your assessment, you must still pay your property tax bills in full by the delinquency dates. Otherwise, you may incur penalties while the case is in the appeals process.

If your lender or financial institution pays your Annual Secured Property Tax Bill using an impound or escrow account, contact your lender/financial institution as soon as possible. Lenders/financial institutions do not usually pay Supplemental Secured Property Tax Bills.

Generally, it takes approximately six months for processing Supplemental Secured Property Tax Bills. You may estimate your Supplemental Secured Property Tax amount by using the Supplemental Tax Estimator.

You may discuss the value with the Office of the Assessor and request a review of your current assessed value versus the current market value (based on comparable sales). This process is commonly referred to as a Decline-in-Value review.

Your home may be excluded from reassessment if the transfer of property was between parent(s) and your child(ren), or from grandparent(s) to grandchild(ren). For additional information, please go to the Assessor’s Website. Also, if you are disabled or age 55 or older, and purchased a new home, you may qualify to transfer the assessed value from your original property to your replacement property. Please visit the Assessor’s Homeowner’s Guide to Proposition 19 for more information.

A Direct Assessment is a non-ad valorem amount charged on a per parcel basis, which may encompass annual charges for services, improvement district charges, community facilities district charges (Mello-Roos), and special taxes and fees. Special districts or other taxing entities usually apply this charge for a service they provide directly to a property.

This charge is included on the Annual Secured Property Tax Bill of the benefited parcel. Examples of these types of assessments are garbage collection, sewer, lights and landscaping maintenance, mosquito abatement, certain improvements, annual improvement bond amounts, and a special tax authorized by the electorate and other such services/benefits. These assessments are authorized under many State codes such as Streets and Highways, Government, Health and Safety, Water, Public Utilities, and others.

For more information, please contact the special district or taxing agency directly at the telephone number listed next to the Direct Assessment on your Annual Secured Property Tax Bill.

If you own and occupy your home as your principal place of residence, you are eligible for a Homeowners’ Exemption that reduces your property taxes by approximately $75.00 annually. The Office of the Assessor will send you an application in about three to four months after the Department of Registrar-Recorder/County Clerk records your deed. You may also visit the Assessor’s Website to apply for the Homeowners’ Exemption.

Yes. Please read below to determine if you qualify for assistance with paying your current or prior year property taxes.

Current Year

-

Property Tax Postponement Program – You may be eligible for the California State Controller’s Office Property Tax Postponement Program for Senior, Blind, or Disabled Citizens. To review the requirements and access the application online, please visit the State Controller’s Office website at

https://www.sco.ca.gov/ardtax_prop_tax_postponement.html.

Prior Year

-

Installment Plan for Escape Assessments (Four-Pay Plan) – You may be eligible to open an Installment Plan for Escape Assessments (Four‑Pay Plan) and pay your escaped assessment over a four-year period. An “escaped” assessment is a correction to a property’s assessed value that the Office of the Assessor did not add to any prior year Annual Secured Property Tax Bill. These bills are usually the result of a taxable event that “escaped” the Office of the Assessor. Pursuant to the California Revenue and Taxation Code Section 4837.5, property taxes due for escaped assessments for a prior fiscal year(s) may be paid without penalty over a four-year period provided the additional property tax is over $500.00 and provided the Four‑Pay Plan is started before the delinquency date of the escaped assessment property tax bill.

To start a Four-Pay Plan, select Four-Pay Plan, follow the instructions, and complete the application. Please note that current year Annual Secured Property Taxes and Supplemental Secured Property Taxes are not eligible for this payment plan.

-

Installment Plan of Redemption (Five-Pay Plan) – You may be eligible to open an Installment Plan of Redemption (Five-Pay Plan) and pay the defaulted property taxes over a five-year period for commercial properties or unimproved vacant residential lots that are less than three years in default, and residential or agricultural properties that are less than five years in default. The opening of the plan will prevent the properties from being sold at a public auction.

To start a Five-Pay Plan, select Five-Pay Plan, follow the instructions, and complete the application. Please note that current year Annual Secured Property Taxes are not eligible for this payment plan.

You may mail your completed Four-Pay Plan or Five-Pay Plan application and payment to:

County of Los Angeles Treasurer and Tax Collector

Attention: Exception Processing

P.O. Box 512102

Los Angeles, CA 90051-0102

-

Relief for Military Personnel – Pursuant to the Federal Servicemembers Civil Relief Act, military personnel on active duty are eligible to defer the payment of their property taxes. The Treasurer and Tax Collector will impose interest at the rate of 6% per annum on the unpaid property taxes in lieu of penalties, costs, and fees imposed under State law.

The military serviceperson, his/her spouse, adult dependent, or any other individual authorized by the serviceperson to act on his/her behalf may complete the Application for Property Tax Relief for Military Personnel form. Next, please visit our Public Inquiries web page to upload the form with copies of the serviceperson’s military orders, by utilizing the dropdown menu under “Email Us” and select the “Other” option. Please write “Federal Servicemembers Civil Relief Act” in the “Comment” box.

This error indicates that you may have entered your banking information (i.e., routing number and account number) incorrectly, or there may be an issue with your bank account. Please confirm your routing number and account number again and enter the information carefully. For more information, please click on the link to show an example of the check (Sample Check). If you receive this error more than once, please contact your financial institution to confirm that your banking information is correct and ask if there is any issue with your account preventing this payment from processing.

The Treasurer and Tax Collector mails over 2.6 million Annual Secured Property Tax Bills each fiscal year, and as a result, you may find it difficult to reach us on the telephone. Before you attempt to contact us, we encourage you to visit our website, where you may obtain answers to the great majority of your questions. Our contact information is listed below.

| Website: | propertytax.lacounty.gov |

| Self-Service: | ttc.lacounty.gov/public-inquiries/ |

| Write Us: | Treasurer and Tax Collector, P.O. Box 512102, Los Angeles, CA 90051-0102 |

| Visit Us: | 225 North Hill Street, First Floor Lobby, Los Angeles, CA 90012 |

| Call Us: | 1(888) 807-2111 or 1(213) 974-2111, our Property Tax Information Line where automated information is available 24 hours a day, 7 days a week. Anyone who is hearing impaired and has TDD equipment may leave a message at 1(213) 974-2196 or use California Relay Services at 1(800) 735-2929. |

| Fax Us: | 1(213) 620-7948 |