SECURED PROPERTY TAXES TERMS

Annual Secured Property Tax Bill

The annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Secured Property Tax Bill

A bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property; the allowance of an exemption that was previously omitted; the correction of a Direct Assessment placed on the property from a municipality or special district; or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law (this excludes a penalty resulting from a delinquent payment).

Ad Valorem

“According to the value” – Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem

“Not according to the value.”

Assessment

The rate or value of a property for taxation purposes.

Assessor’s Identification Number (AIN)

A 10-digit number (a.k.a., map book, page, and parcel) that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay Service

A telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Closing/Settlement Statement

A document that provides the closing details on a real estate transaction including the escrow deposits for property taxes, commissions, loan fees, points, hazard insurance, and mortgage insurance. Also called HUD-1 Settlement Statement or Settlement Sheet.

Current Year

The current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Current Assessed Value

The assessed value the Office of the Assessor assigns to a property.

Current Market Value

The estimated resale value of a property.

Delinquent/Delinquency

Each current year installment payment that is past due.

Delinquency Date

The close of business on the last business day to make a timely installment payment, e.g., December 10 for the 1st installment payment due on November 1 and on April 10 for the 2nd installment due on February 1, for the Annual Secured Property Tax Bill. A payment is late if the Treasurer and Tax Collector does not receive your payment by the delinquency date, or if the United States Postal Service does not postmark your payment on or before the delinquency date. If the delinquency date falls on a Saturday or Sunday, by law, the Treasurer and Tax Collector extends the delinquency date to the close of business on the next business day.

Defaulted

The unpaid property taxes at the end of the fiscal tax year.

Direct Assessment

The costs of services or benefits (e.g., weed removal, landscape, flood control, refuse, sewer, sidewalk repair, and lighting) that the Department of Auditor-Controller adds to the Secured Tax Roll at the request of local taxing agencies.

Electronic Check

An electronic form of payment made via the Internet that is designed to perform the same function as a conventional paper check.

Escape Assessment

A taxable or an assessable prior year event that escaped the Office of the Assessor, which as a result, was not added to the corrected property’s assessed value to the prior year Annual Secured Property Tax Bill.

Escrow

A contractual arrangement in which a third party (title company or escrow company) receives and disburses money or documents related to the sale of a property.

Escrow Statement

A statement with the breakdown of credits, debits, and payments for the buyer and the seller at the closing of a real estate transaction.

Exemption

A protection or exclusion on a portion of property taxes.

Fiscal Tax Year/Tax Roll Year

A fiscal tax year runs from July 1 through June 30; a tax roll year refers to the fiscal tax year. For example, Fiscal Tax Year 2023-24 runs from July 1, 2023 through June 30, 2024, and the Tax Roll Year is 2023-24.

Five-Pay Plan

A five-year payment plan that allows defaulted property taxes to be paid in 20 percent increments of the redemption amount, with interest, along with the current year property taxes annually.

Four-Pay Plan

A four-year payment plan that allows prior year escaped assessments to be paid in 20 percent increments of the escaped property taxes, without penalties or interest, along with the current year property taxes annually.

Impound/Escrow Account

An account a taxpayer establishes with his/her lender to pay property taxes.

Military Orders

The documentation required for military personnel to apply for relief of property tax penalties.

Pay Online

To make an electronic payment for property taxes via the Department of Treasurer and Tax Collector’s website. This is not a payment through your bank’s online bill payment or home banking functions.

Personal Identification Number (PIN)

An alphanumeric code necessary for completing electronic financial transactions. The PIN can be found on any original Secured Property Tax Bill.

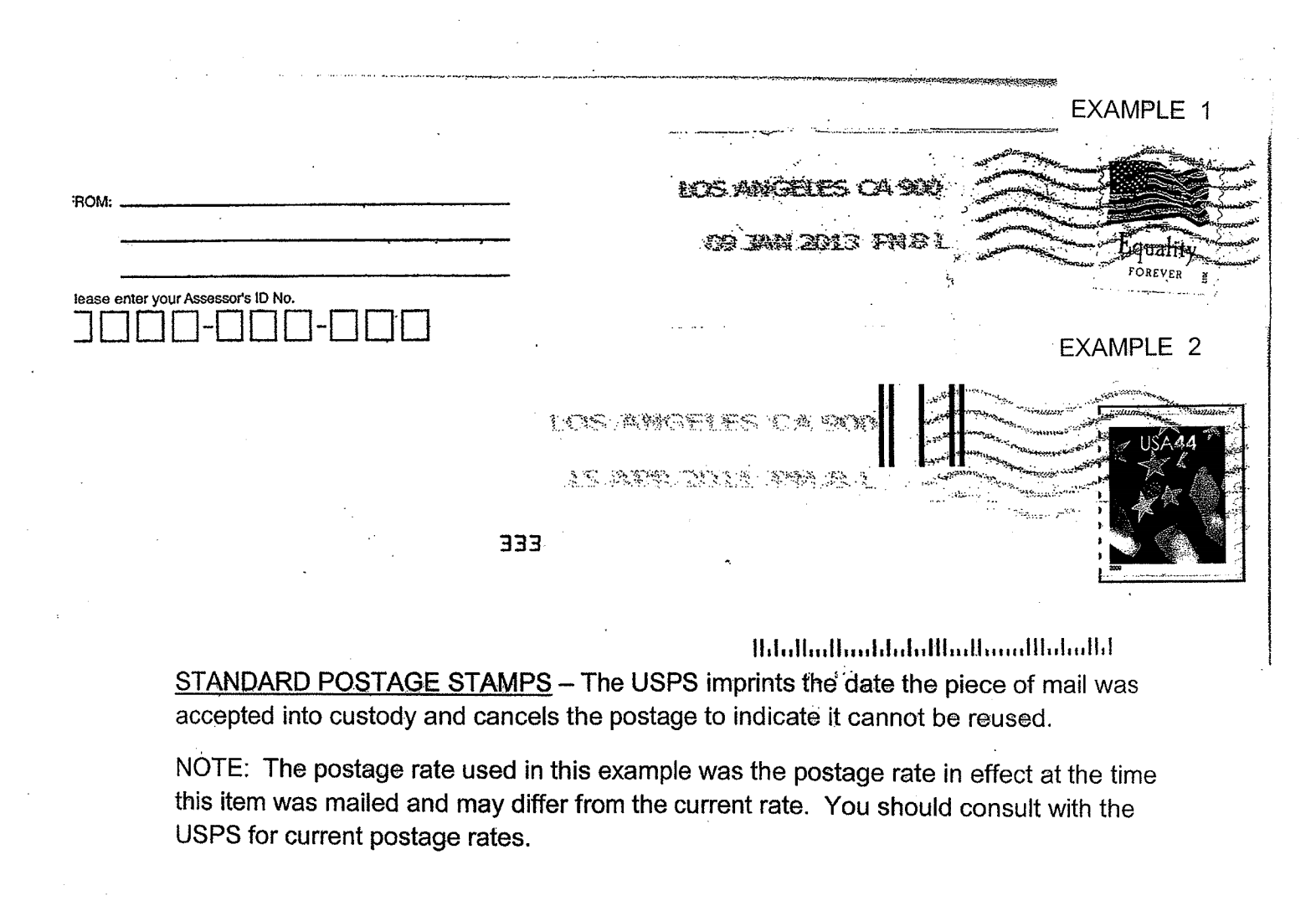

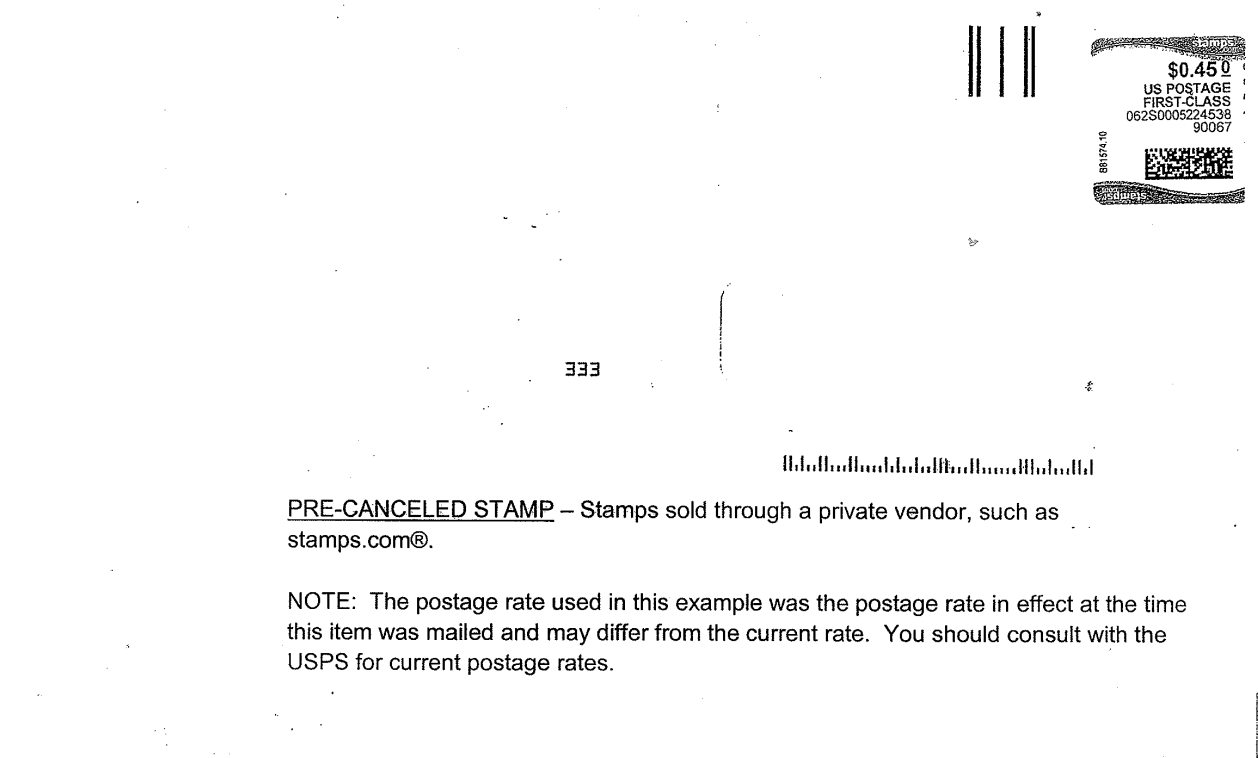

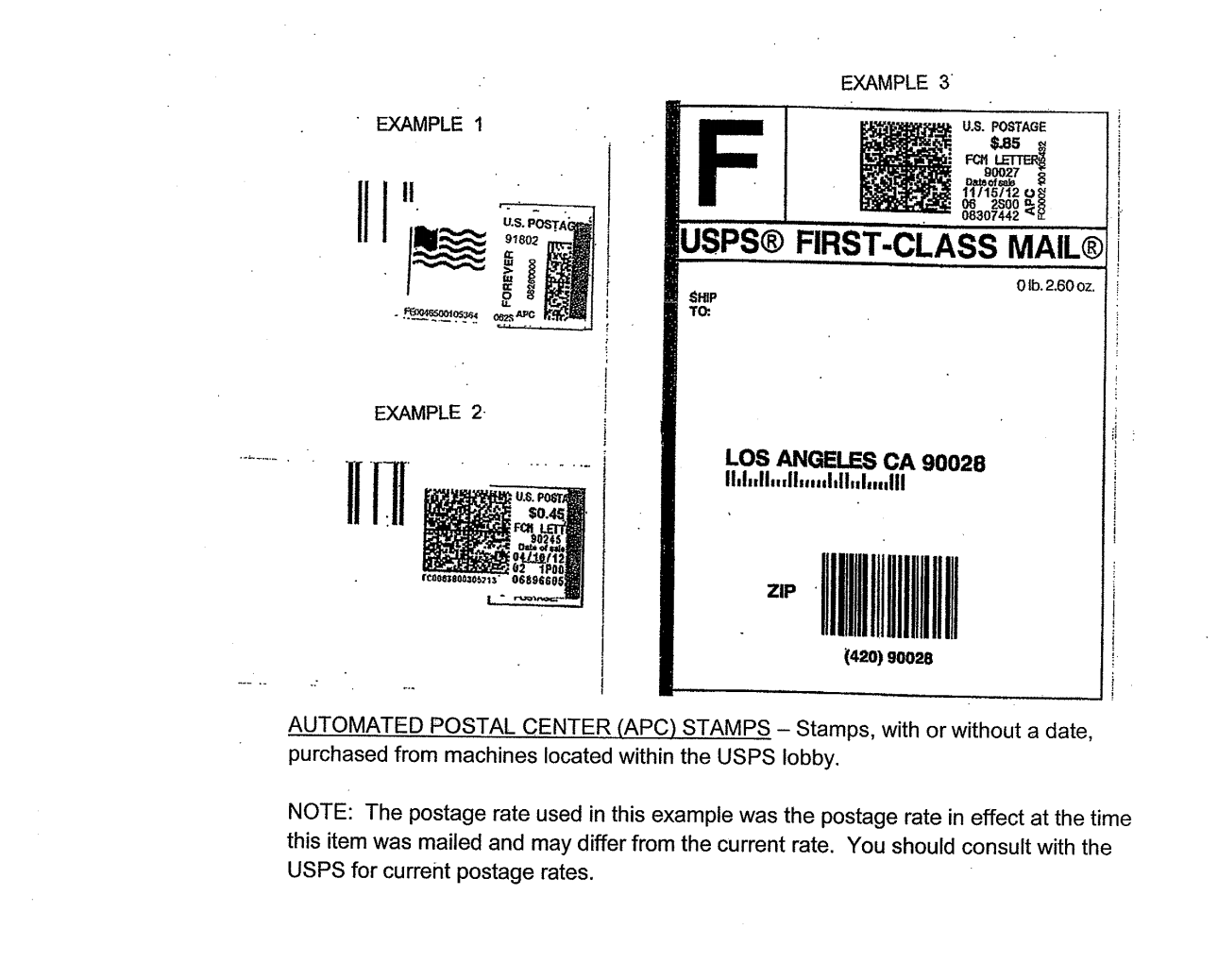

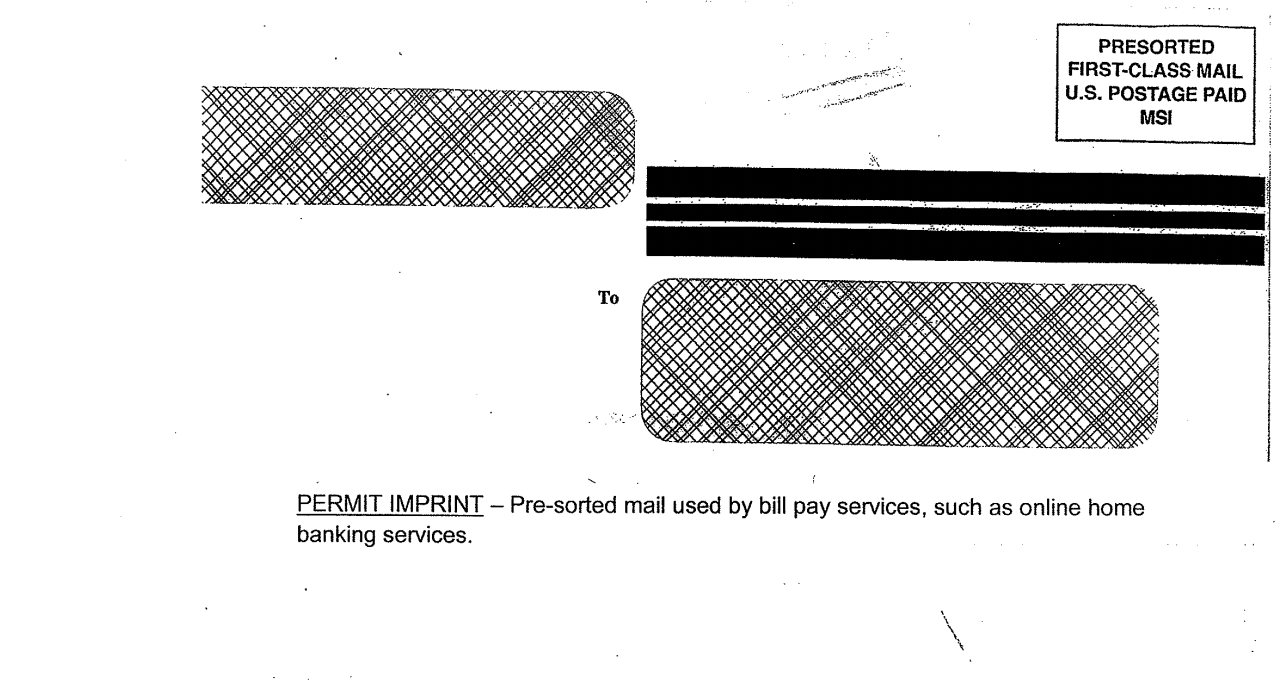

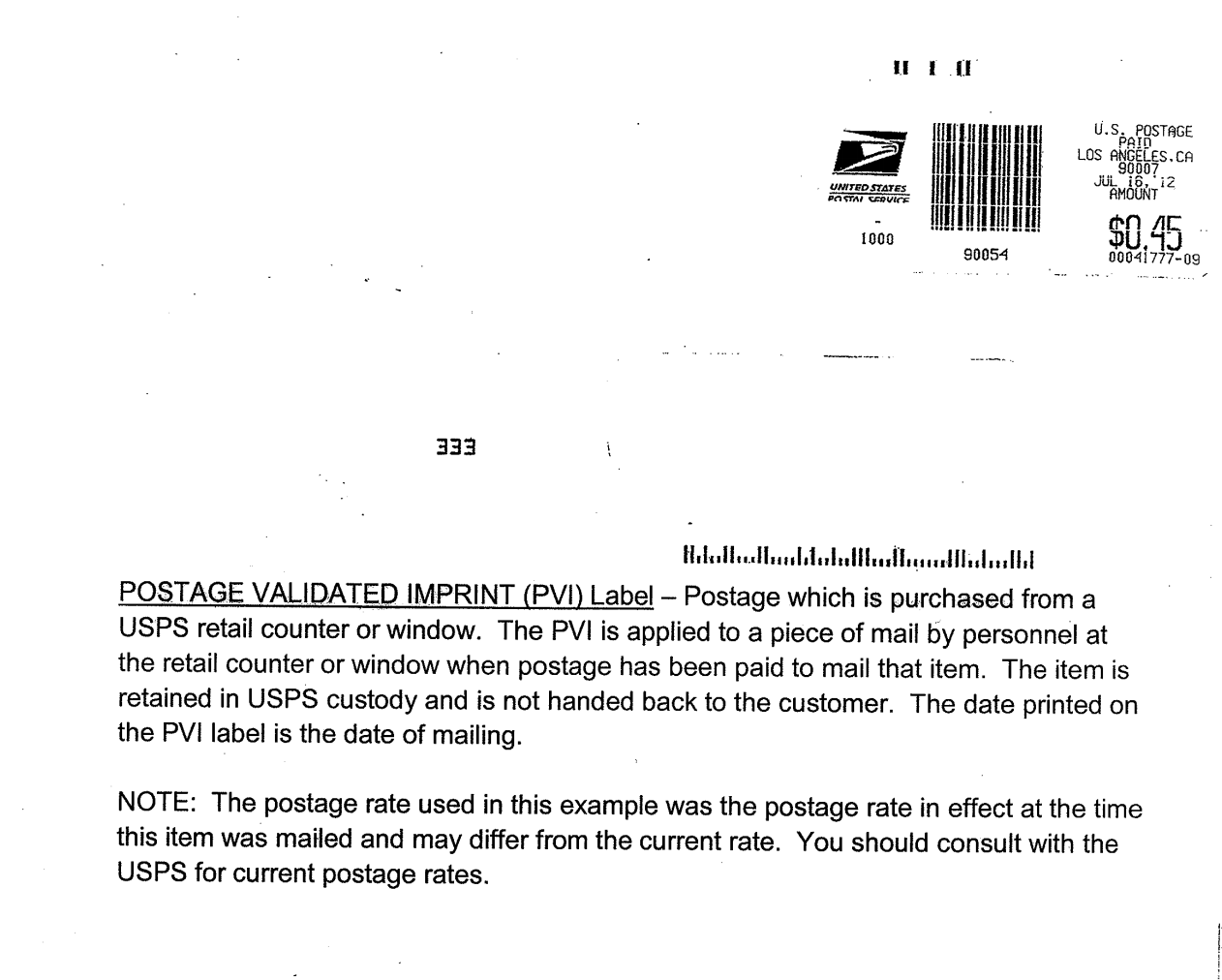

Postmark

A United States Postal Service (USPS) marking on an envelope or package that indicates the date and time a mail piece was taken into custody by the USPS. Please visit https://ttc.lacounty.gov/avoid-penalties-by-understanding-postmarks/ for samples.

Prior Year

The property taxes that have defaulted or escaped during the prior fiscal tax year.

Property Tax Postponement

A State program offered to senior, blind, or disabled citizens to defer their current year property taxes on their principal residence if they meet certain criteria.

Public Auction

An auction, held pursuant to the California Revenue and Taxation Code Section 3691, in which the Department of Treasurer and Tax Collector auctions and sells tax-defaulted properties subject to the power of sale.

Reassessment

The rate or value of a property when a change in ownership or completion of new construction occurs.

Reassessment Exclusion

A taxpayer’s request to be excluded from reassessment of the value of a property after meeting certain conditions (e.g., transfer of property from parent/grandparent to child/grandchild or transfer of base year value).

Secured Property Tax Information Request form

A form to request information on multiple properties all at once.

Service Fees

A charge for processing all credit/debit card transactions for property tax payments.

Substitute Secured Property Tax Bill

A replacement bill used for making property tax payments on lost or missing original bills. This bill does not contain the Personal Identification Number or a breakdown of the General Levy, Voted Indebtedness, or Direct Assessments.

Supplemental Secured Property Tax Bill

An additional tax bill issued as a result of the reassessment of the value of a property upon a change in ownership or completion of new construction.

Supplemental Tax Estimator

A tool to estimate the expected amount of Supplemental Secured Property Taxes on a recent purchase of property. Please visit https://assessor.lacounty.gov/homeowners/supplemental-tax-estimator/.

Taxable Event

An event that requires the Office of the Assessor to assess or reassess the value of a property (e.g., change in ownership or completion of new construction).

Taxing agency

A local agency within a specific tax rate area (e.g., schools, fire, water, parks, districts, departments, community services, etc.).

TDD Equipment

A telecommunication device such as a teleprinter that is designed for people who have hearing or speech difficulties.

Third-Party Payment Processor

A Los Angeles County contracted vendor that processes all credit/debit card property tax payments.